Running a small business means being flexible and adapting to change faster than the competition. Every small business owner knows the value of cash flow but are you taking full advantage of what credit, or more specifically, a business line of credit can do for you and your team? Let’s talk through the key points of what a business line of credit is and what you can expect after opening one for your business.

How Does a Business Line of Credit Work?

A business line of credit for small business is functionally an amount of money that you can spend, repay, and redraw for the length of your agreement with whatever financial institution you opened the line with. As you spend money in your line of credit, that money counts against your overall line limit. As you repay that money, you can then spend it again as long as your line stays open.

The small business that opens a line of credit is only responsible for paying interest on the balance that remains at the end of a billing period. So, this means that if you fully pay off your business line of credit before the end of each billing period (generally monthly), you will not pay interest on your line.

Where to Get a Business Line of Credit

Business lines of credit are available from a wide range of financial institutions ranging from larger national banks all the way to small online lenders. Let’s talk about the difference between what you can expect from a line of credit at a larger institution versus an online lender.

- Banks and Major Financial Institutions: If you are looking to open a business line of credit with a bank or credit union, you can expect generally steep requirements for your credit history, business credit score, your annual revenue, and your overall business history. Many major institutions will also ask for some kind of collateral when opening your line. If an institution requires collateral, it means they are offering secured lines of credit, but we’ll get into that later.

- Online Lenders: There is an almost uncountable number of online lenders active today, so it is impossible to speak for all of them, but you can expect some lighter credit requirements and maybe even opportunities for start-ups, something almost impossible to find at major banks. Of course, in exchange for a higher risk line, your interest rate will likely be higher to account for it. It is also likely that most online lenders offer a quicker application process compared to major institutions.

How to Get a Business Line of Credit

While every business ought to have their own process, here are our four recommendations for connecting your business with a line of credit in a smart and comprehensive way.

1. Decide How You Will Use Your Business Line of Credit

While it’s true that a business line of credit won’t accrue interest when it goes unused, that doesn’t mean that your business should open one simply to have one. Think about the potential situations where you may use your line. For example, would your line of credit ever be used to cover payroll?

Or maybe for inventory? Or do you want to use your line for emergencies and unexpected expenses only? No matter what your answer is, your next step is to determine the most money that you could ever require for any of those use cases. The figure you come up with likely represents the credit limit you should look for in your line of credit.

2. Review Your Current Financial Portrait

Just about every lender is going to want to get a good picture of your recent financial history as well as your business credit score. It is possible lenders may want to see your personal credit as well if you are a newer business owner or your business credit isn’t developed enough.

Your first step should be to make PDF copies of at least the last six months of your business bank statements, and a copy of your ID is helpful to have on hand as well.

3. Compare Lenders

Feel free to talk with multiple lenders and collect as much information as you think you’ll need before making your first inquiries. It doesn’t hurt to find lenders who have already funded your industry or have made strides for causes you already believe in. Choosing your lender ought to be just as involved as choosing your final offer.

4. Get Your Documents in Form and Start Applying

This is the easy part. Many online applications today are straightforward and meant to save business owners like you time.

Business Line of Credit Application Requirements

Business line of credit application requirements vary by business, but most lenders will require the following:

- Business information, including type of business and ownership.

- Financial statements to demonstrate proof of revenue and cash flow.

- Credit history, both personal and business credit.

- Proof of time in business.

- A business plan to demonstrate the intended use of funds.

- Collateral, if you’re applying for a secured business line of credit.

What is a Business Line of Credit Used For?

While some business owners like to use their business line of credit in predictable and repeatable ways like covering payroll or inventory, there are several others who keep their line of credit clear in the case of an emergency. Since a line of credit is a re-drawable sum, any expense you expect to repeat itself may be a good fit for your line of credit as long as you are certain you can pay back the full amount before the end of the billing period. If not, you will have to pay interest on the unpaid amount.

Secured Versus Unsecured Line of Credit

A secured line of credit is a line of credit backed with some amount of collateral. This can be real estate or any asset of value that you declare would be forfeited in the event your line of credit went unpaid. An unsecured line, then, is a line of credit tied to collateral. As you may guess, secured lines of credit generally have more generous interest rates and terms while unsecured lines (because they present more risk to a lender) tend to have high interest rates. Repayment terms on an unsecured business line are also likely to be considerably less lenient, as there is much more risk on the lender’s side.

Business Line of Credit Versus a Business Credit Card

The biggest difference between a business line of credit and a business credit card is how you can use the two products. While business credit cards can be used in just about every transaction that allowscard payment, lines of credit are considerably more flexible, as they represent an amount of capital provided on behalf of a lender. It’s just about impossible to pay an invoice or payroll, for example, with a business credit card, but this is more than possible with a line of credit.

Another key difference between business lines of credit and business credit cards is that lines of credit generally have higher draw limits than business credit cards. A business line of credit amount is generally chosen based on larger and not short-term expenses like payroll or restocking inventory. A business credit card, while still likely to have a limit higher than a personal card, often isn’t suited for the same expenses that a line of credit can handle.

What to Consider Before Getting a Business Line of Credit

While a business line of credit may seem like the ideal option for your business, it can depend on the specifics of the line of credit offered. Consider rates, terms, and alternative options before taking out a line of credit.

Rates and Terms

Each lenders will offer different rates and terms for a business line of credit. While comparing lenders, pay attention to the rates and terms available to your business. It’s also worth looking at repayment terms at this time.

Line of Credit Alternatives

Aside from a line of credit, small businesses have other financing options available, including:

- Term loans: Term loans come with a fixed loan amount, rate, and repayment schedule. The fixed aspects of a term loan make it an attractive option for business owners who want a lump sum loan with a consistent repayment schedule.

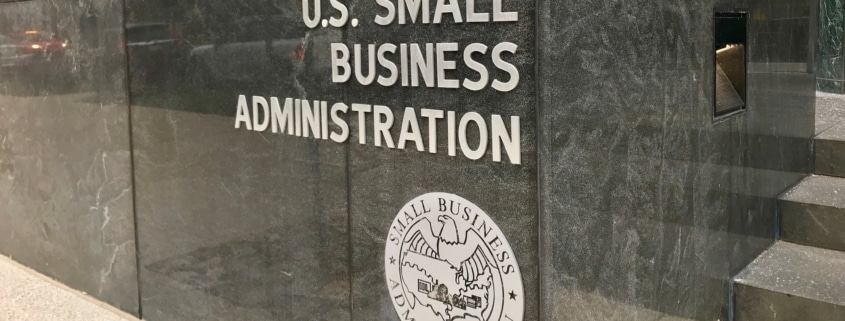

- SBA loans: Supported by the U.S. Small Business Administration, SBA loans are guaranteed by the SBA but facilitated through a lending partner, such as a bank, credit union, or online lender. The SBA has multiple loan programs to choose from.

- Equipment financing: Equipment financing lets a business take out a secured loan to purchase equipment. When the loan is paid off, the equipment become fully owned by the business.

- Revenue-based financing: With revenue-based financing, small businesses can secure financing in return for a percentage of business revenue, up until the predetermined repayment amount is reached.

Business Line of Credit FAQs

Even with a good grasp of the basics of a line of credit, it is more than understandable to still have some questions. These are the most common questions when it comes to business lines of credit.

How Do You Pay Back a Business Line of Credit?

In most cases, it is possible to pay back your business line of credit in the same way you would pay back any loan or lump sum financing with a lender. While lender methods will vary, it is more than likely that lenders will give you a specific online portal for repayment.

How Do I Request a Line Increase?

It is more than likely that most lenders will determine your eligibility for a line increase in the same way that they will assess your ability to take on more financing in general. With that in mind, you may want to get in contact with your lender’s renewal department.

When deciding whether your business needs a line increase, it is important to think about both the maximum amount of money that you may need to draw in a billing period. But an equally important consideration is the highest amount of interest you are able to take on. Do some thought experiments

and talk with your lender to better understand the maximum line size that could work for your business.

Does a Business Line of Credit Help Build Business Credit?

Responsibly and consistently repaying your line of credit at the end of each billing period is a proven way to show credit responsibility. While there is no way to know for sure how much keeping good standing with your line will help your overall credit score, you’re certainly not hurting your score by doing so.

Can an LLC Open a Business Line of Credit?

Yes, LLCs can open a business line of credit as long as they meet eligibility requirements. To qualify, LLCs should make sure they have a business plan, bank statements, proof of revenue, and both business and personal credit scores ready.